About Mortgage Lenders

When we go ahead with the home buying process it is confusing and a little intimidating to shop for a lender.

choosing from so many companies and types of lenders could be difficult. But when you understand the differences between the main types of lenders it would be helpful to narrow down the search.

Choosing the right type of loan is obviously important, but when you chose the right lender it could save you money, time, and effort. Hence taking the time to shop around is important.

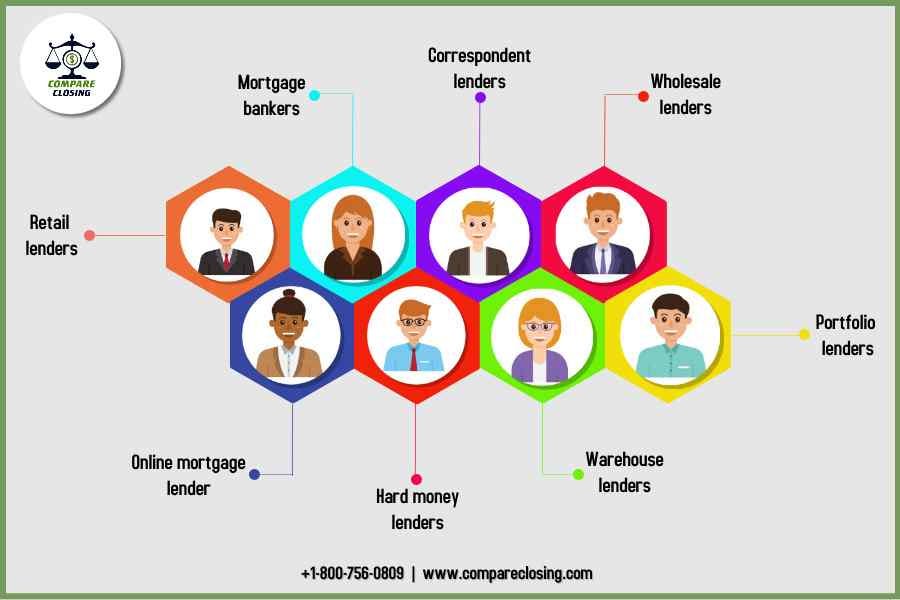

There are different types of mortgage lenders like — retail lenders, direct lenders, mortgage brokers, correspondent lenders, wholesale lenders, and others, and some of these categories overlap.

In your home-buying research you would have seen the terms “mortgage lender” and “mortgage broker“, but their functionality and meanings are different.

What is a mortgage lender?

A financial institution or mortgage bank that offers and underwrites home loans is known as a mortgage lender. There are specific borrowing guidelines for lenders to verify a borrower’s creditworthiness and ability to repay a loan.

The terms, interest rate, repayment schedule, and other key aspects of the mortgage are set by the mortgage lenders.

What is a mortgage broker?

A mortgage broker works as an intermediary between borrowers and lenders. The mortgage brokers do not have a say in the borrowing guidelines, timeline, or final loan approval.

The brokers are licensed professionals who collect borrower’s mortgage applications and qualifying documentation, they can counsel borrowers on things to address in their credit reports and with their finances to strengthen their chance of qualifying.

As many mortgage brokers work for independent mortgage company they can shop multiple lenders on behalf of the borrower, helping them to find the best possible rate and deal.

After a loan closes the mortgage brokers are usually paid by the lender; sometimes the broker’s commission is paid upfront at closing by the borrower.

The Mortgage brokers work with different lenders, and it’s important for the borrower to find out which products those lenders offer.

One thing to know is that brokers do not have access to products from direct lenders. A borrower would need to shop at a few lenders to get the best loan offer.

Many mortgage brokers and mortgage lenders charge a fee of 1% of the loan amount. These commissions are either paid by the borrower or lender.

A borrower can take a loan where they won’t pay a loan origination fee and the lender will pay the broker fees. However, mortgage lenders charge higher interest rates which are negotiated by some brokers for an up-front fee to the borrower in exchange for their services.

Before going ahead with a prospective broker they need to be asked how much they charge and who pays for the fees.

How do the brokers help?

A borrower saves time and effort because the mortgage brokers can help by shopping multiple mortgage lenders for the borrower.

If the borrower needs a loan with a low down payment requirement or if his credit is not so great then the brokers can look for lenders that offer products tailored for such situations. Brokers typically have well-established relationships with lots of lenders.

Their connections can help the borrower to score competitive interest rates and terms. And since their compensation is tied to a successful loan closing, brokers deliver personalized customer service.

Once a mortgage broker ties the borrower with a lender, they don’t have much control over how the loan is processed, and the time it takes, or whether the borrower will receive final loan approval.

This can end in to delay in the closing process. Sometimes the lender might charge a higher interest rate to cover the broker’s commission, leading to more cost.

Types of mortgage lenders

- There is a fee charged by the mortgage lenders for their services.

- Mortgages are provided directly to consumers by retail lenders.

- Direct lenders originate their own loans, either by funding themselves or borrowing them elsewhere.

- Borrowers’ loans are funded with their own money by portfolio lenders.

- Wholesale lenders like banks or other financial institutions don’t work directly with consumers. They originate, fund, and service loans.

- The initial lender making the loan is called correspondent lenders they might even service the loan.

- By offering short-term funding the warehouse lenders help other mortgage lenders fund their own loans.

- Private companies or individuals with significant cash reserves are hard money lenders, who are chosen by borrowers who want to flip a home after a quick renovation.

Mortgage bankers

Mortgage bankers in the U.S. are mostly mortgage lenders. The mortgage bank could be retail or direct lenders like large banks, online mortgage lenders, or credit unions.

To fund the mortgages they issue to consumers these lenders borrow money at short-term rates from warehouse lenders.

And after the loan closes, the mortgage banker to repay the short-term note sells it on the secondary market Fannie Mae or Freddie Mac, or to other private investors.

Retail lenders

Mortgages are provided not to institutions but directly to consumers by Retail lenders. Banks, credit unions, and mortgage bankers are retail lenders.

Along with mortgages, retail lenders offer other products, like checking and savings accounts, personal loans, and auto loans.

Direct lenders

Direct lenders originate their own loans. They at times use their own funds or borrow them from another place. Mortgage banks and portfolio lenders are direct lenders.

Their specialization in mortgages distinguishes a direct lender from a retail bank lender.

Consumers are sold multiple products by retail lenders, they tend to have more stringent underwriting rules. With their focus only on home loans, direct lenders have more flexible qualifying guidelines and alternatives for borrowers who have complex loan files.

Just like retail lenders, the direct lenders, offer only their own products so one needs to apply to multiple direct lenders for comparison shop.

The only potential drawback if you prefer face-to-face interactions is that many direct lenders operate online or have limited branch locations.

Portfolio lenders

Borrowers’ are funded for their loans with their own money by a portfolio lender. So a portfolio lender isn’t obliged to the demands and interests of outside investors.

Portfolio lenders have their own borrowing guidelines and terms, which could be appealing to certain borrowers. For instance, if a borrower needs a jumbo loan or is buying an investment property then he might find more flexibility while working with a portfolio lender.

Wholesale lenders

Banks or other financial institutions that offer loans through third parties, like mortgage brokers, other banks, or credit unions are called wholesale lenders. They don’t work directly with consumers but originate funds, and many times service loans.

It will be the wholesale lender’s name and not the mortgage broker’s company which will appear on loan documents because the terms of your home loan were set by the wholesale lender.

Many mortgage banks run both retail and wholesale divisions. Shortly after closing the wholesale lenders usually sell their loans on the secondary market.

Correspondent lenders

When a borrower’s mortgage is issued the correspondent lenders come into the picture. They are the initial lender that makes the loan and perhaps service the loan.

Correspondent lenders sell mortgages to investors/ sponsors who re-sell them to investors on the secondary mortgage market.

The main investors being Fannie Mae and Freddie Mac. A fee is collected from the loan when it closes by the correspondent lenders, who immediately sell the loan to a sponsor to make money and eliminate the risk of default in case of payment failure.

The correspondent lender must hold the loan if a sponsor refuses to buy the loan, and find another investor.

Warehouse lenders

Other mortgage lenders are helped by warehouse lenders to fund their own loans by offering short-term funding. As soon as a loan is sold on the secondary market the warehouse lines of credit are usually repaid.

They too don’t interact with consumers. The mortgages are used as collateral until their clients who are smaller mortgage banks and correspondent lenders, repay the loan.

Hard money lenders

Hard money lenders are often the last alternative if a borrower can’t qualify with a portfolio lender or if they renovate homes to resell quickly. Hard money lenders usually are private companies or individuals with significant cash reserves.

These loans generally must be repaid in the shorter term so only investors interested to buy, repair, and quickly sell homes for profit are interested in it.

While these lenders are flexible and fast, they charge heavy loan origination fees and their interest rates are quite high they also require a substantial down payment.

The property is used as collateral to secure the loan by hard money lenders and if the borrower defaults, the lender will seize the home.

Online mortgage lender

With the automation of the application process, it is a huge time-saver for busy families or professionals who are searching for a home, with their busy lives.

A few lenders provide apps to apply, monitor, and manage the loan from a mobile device.

It is always good to browse through different lenders’ to know their products, rates, terms, and lending process.

When you compare shop, along with working on your credit and financial goals, will help you find the best loan for your needs.

Conclusion

Searching for the right lender and loan can be a tiresome process. When you do your research before starting the process will help you with lenders and brokers.

To compare mortgage rates, terms, and products you might have to go through the pre-approval process with a few lenders. Having your income, savings, and document ready will help your lenders and brokers to offer you the best rates and products.

https://www.compareclosing.com/blog/the-types-of-mortgage-lenders/