Banking and financial services are one of the most lucrative sectors for the IT industry. The market size of the BFSI sector is estimated to be currently at $35.3 billion. In comparison, it is expected to grow to $66.02 billion by 2026. Banking software helps the customers connect with their respective bank branches from anywhere. Multi-channel banking software helps the customers complete their transactions through multiple mediums like mobile, internet, and branch.

Banking software provides a high level of convenience to the customers, which in turn helps increase the banks’ customer base. Many banks and financial institutions want to build banking software to fulfill the needs of their clients but they don’t know where to start. As a leading software development company, we have tried to address this as well as other questions about banking software development. In this guide, the banking and financial institutions will find the A to Z of building efficient banking software for their project needs.

The demand of banking software market

The growth of the banking sector has accelerated in the digital age. Today customers rarely need to visit the bank as most of the banking operations are completed with the help of mobile banking app or by logging on to the online bank portal.

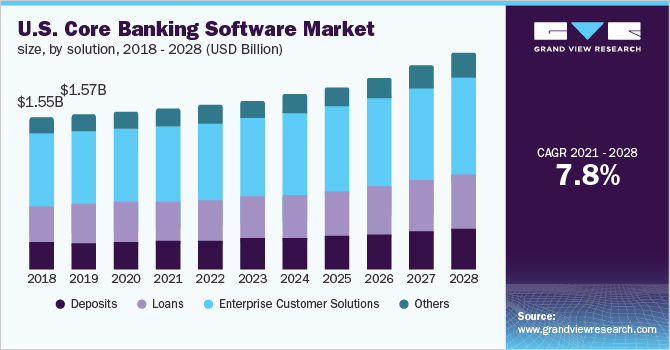

The global banking software market was estimated to be valued at around $9.84 billion in 2020 and is expected to grow at a CAGR of 7.8% till 2028.

The most successful banking software

There is a wide range of banking software available in the market today. While going for readymade banking solutions, businesses need to choose a solution that will fit well based on their requirements. Mentioned below are some of the most successful banking software.

- Temenos

- Avaloq

- Cleartouch

- Mambu

- Finastra

- Oracle FLEXCUBE

- CorePlus

- FIS Profile

- EBANQ

- BankWare

Advantages of mobile banking app software

Banks are fast digitizing themselves by equipping themselves with high-quality software. Banking software makes the lives of banks as well as their users easy in a lot of ways. We have listed some of the major benefits of using banking software.

- Reduce operating costs by using integrated technology solutions.

- Ensure regulatory compliance and security.

- Shorten delivery time for client services.

- Provide banking solutions to the customers on the go.

- Gain a competitive advantage.

- Increase productivity of the team.

- Build customer trust through multi-channel communication.

What kinds of software are used in banks?

Multiple kinds of banking software are present in a bank. Let us discuss the main ones.

- Software for managing the financial operations and transactions

- Document management software

- Administrative management software

- Customer service solutions

Software to manage financial operations

Software for managing the financial operations and transactions consists of the following features

- Management accounting

- Balanced scorecard system

- Management of consolidated financial statements

- Transfer management of financial resources

- Financial planning and budgeting

Continue reading: A Comprehensive Guide on Banking Software Development