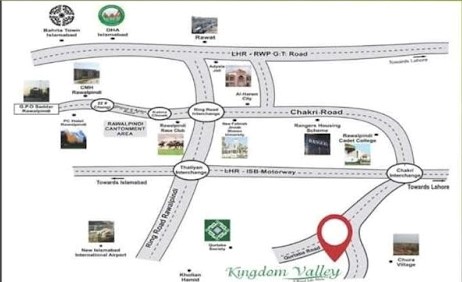

What is the best way to determine when it is time to sell your rental investment? If you are planning to purchase rental properties, making a plan for the appropriate time to sell your property kindom valley Islamabad is vital.

I have had the pleasure of working with many people throughout the years and showed them how to buy rental property. There are numerous aspects to consider in the purchase of a property to invest. There is a definite the right moment to sell.

How to Buy an Investment Property

If the property is in an ideal location? Is it near shoppingareas, in a neighborhood with good schools and is it accessible to interstates and connecting roads?

Do the investment property have a solid foundation? What type of issues does the home have? If it is in need of a new roof or the foundation has been submerged and creating issues inside the more structure it's not a good investment at this time. If the issue is only cosmetic (needs an upgrade to the bathroom floor or paint, or carpeting) it may be worthwhile. Inspection reports will reveal the flaws in the property so that the buyer and real property professional can make a an informed decision.

- Do you have enough of a downpayment in order to purchase the rental property to ensure financing won't be a problem? In the current real estate market the majority of lenders will view a down payment of 40-50% as an acceptable risk. If you are able to invest in the property completely - this is much better.

The earnings from the property must outstrip expenses. Choose a trustworthy tenant as well as a trustworthy management company, and a sound leasing agreement that will make your property investment profitable. Property management costs can be tax-deductible.

- For residential property investments Single-family homes, as well multi-tenant homes such as duplexes or fourplexes are fantastic ways to create money and wealth. Investors may wish to think about apartment complexes. In this instance, a commercial property loan may be needed to secure financing.

- Use depreciation on the investment property as a way to claim an annual tax deduction. Talk to your accountant who will determine the depreciation deduction to property, its appliances -- even window treatments. The government still allows tax deductions for the acceleration of depreciation of homes. The most savvy real estate investors utilize this deduction to increase cash flow and net operating profits on the property.

When to Sell a Rental Property

I have a term that applies to properties that need to be sold: alligator properties. The properties will eat the investor alive by causing expenses. When an investor looks at the bottom line on an alligator property , there's no money - only costs. A property with an alligator name today may have been a good investment ten years ago. However, some people will continue to maintain a property until it depletes all of the profits they may have made within the first 5-7 years.

If a property is sentimental in value (it is your very first home, or perhaps your mother was once the owner but now she's deceased) Investors may tend to want to hold onto it. Being emotionally attached to a property investment which is meant to earn income isn't a good idea. In some cases, people hold this kind of property, even when it's not profitable. It is possible to consider selling this property.

After a specific number of years depreciation tax deduction is used up on a property. Consult your accountant to determine when this depreciation is no longer in use. If the investment cannot longer be depreciated , it's the time to let that property and get a new rental.

If you are considering selling this property while applying tax 1031 code to ensure that no capital gains tax will be imposed on the profits. To paraphrase the code, an owner can sell one property for exchange of securitized property or tenant on a common piece of property. Transfer the gains from one property into another investment to boost wealth and preserve it.

On average, during twelve years of ownership, it's time to dispose of your investment. The selling decision will be contingent on two factors. 1. Does the property have enough equity? the property to sell? Perhaps, you have pulled away too much equity from the property? 2. Does the market for real estate permit you to sell your home and obtain a nice profit? Consult a real estate expert for a personalized market analysis for the property to see how feasible it is to negotiate an amount that will yield the seller a decent income.

Alligator properties aren't profitable due to a myriad of reasons. I am amazed at the number of investors who do not realize how their properties are losing funds. If you own property which is losing money, then ask your real estate professional or accountant to conduct an analysis of income and cost. If the property is an alligator property , then think about selling.