In this article, we’ll discuss insurance regulatory laws, and how to follow them. This guide is perfect for startup founders, serial entrepreneurs, and insurance product managers.

We’ll discuss the following here:

- What is insurance compliance?

- Overview of insurance compliance

- How to deal with insurance regulation as a startup

- And more!

Let’s discuss the points above in detail:

What is Insurtech Compliance?

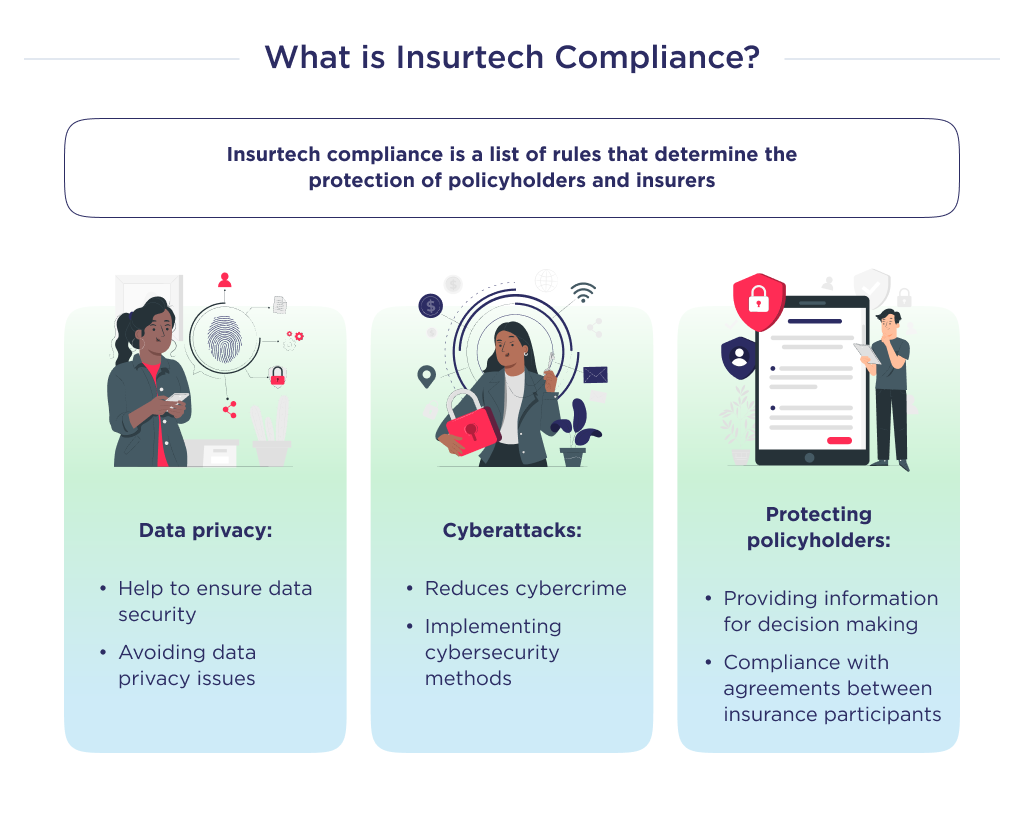

Insurtech compliance is a group of regulations that guides how insurance technologies operate. It ensures that the interests of both policyholders and insurers are well covered. Compliance is enforced by governmental organizations.

To determine insurance compliance, government agencies consider the following:

- Data privacy: 72% of internet users have data privacy concerns. And since Insurance companies handle lots of data, which is used for underwriting and risk-modeling. Regulatory laws are put in place to help make data secure.

- Cyberattacks: Cybercrimes cost the world government a value of 1% of global GDP. Insurtech compliance reduces the occurrence of cybercrimes by creating laws to help insurance companies adopt cybersecurity practices.

- Policyholder protection: Governmental agencies make laws to ensure consumers have enough information to make informed decisions. Also, they ensure agreements between insurers and policyholders are honored.

You now understand what insurance tech compliance means. Let’s do an overview of insurance compliance laws, the country where they hold them, and their meaning.

You now understand what insurance tech compliance means. Let’s do an overview of insurance compliance laws, the country where they hold them, and their meaning.

Interested in Launching an Insurance App?

Contact us now. Our development team can help you create a custom insurance app.

Overview of InsurTech Regulations

Insurance technology regulations are getting tighter as the years go by. Experts believe that business risks are changing, and governments are becoming more innovative with compliance enforcement.

To stay on the side of the law, we’ll help you understand relevant insurance regulations as it pertains to the UK, USA, Western Europe, and Australia. Let’s begin:

InsurTech Regulations in the US

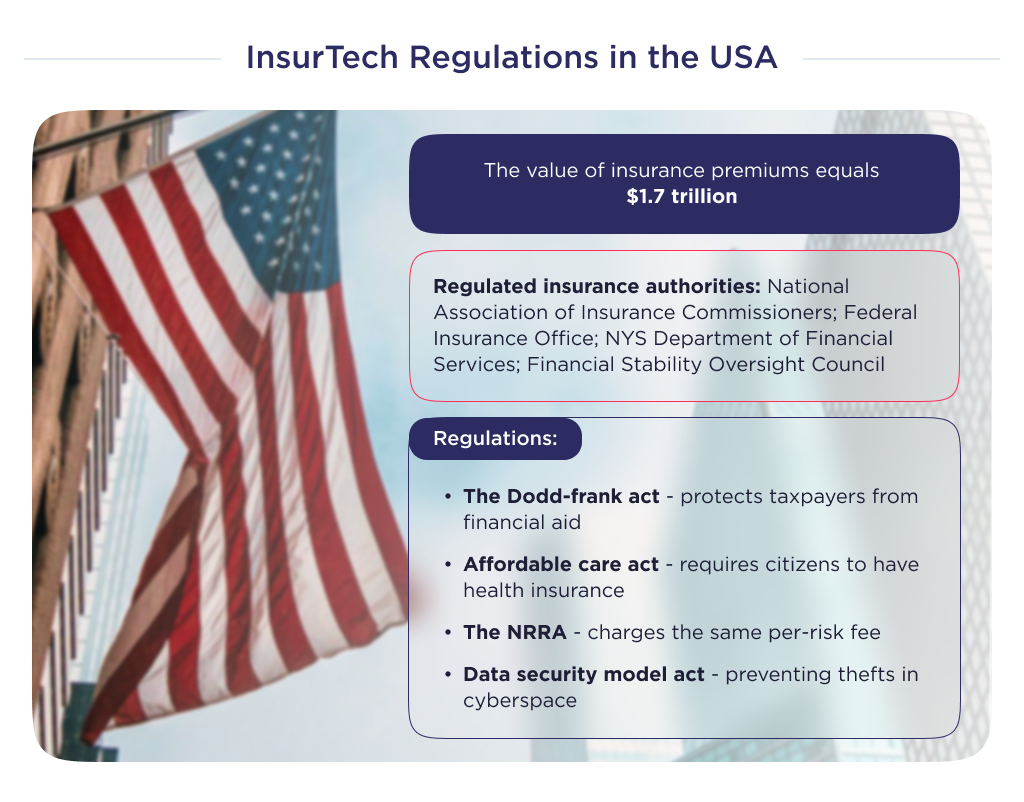

The United States has the largest insurance ecosystem, as its value of insurance premiums is estimated at over $1.7 trillion. The operations of this industry are guided by laws to guarantee that things work smoothly.

Insurtech startups in the US are regulated by the National Association of Insurance Commissioners (NAIC). Federal Insurance Office (FIO), NYS Department of Financial Services, and Financial Stability Oversight Council (FSOC).

Each of these organizations has functions that include:

- NAIC. They establish practices for the insurance industry and provide support for insurers. It also regulates policy pricing.

- FIO. They monitor all insurance companies and ensure access to policyholders is well protected.

- NYS Department of Financial Services. They regulate the activities of all coverage providers in New York.

- FSOC. They monitor the stability of all financial organizations, including insurtech and fintech.

Here are some insurance regulations for startups in the US:

RegulationsMeaningthe Dodd-frank actThis act ensures stability for insurance companies based in the United States. It ensures that they are accountable and transparent.It protects taxpayers from bailouts and reduces exploitative practices.

Affordable care actThis 2010 law mandates health care insurance firms to spend 80-85% of premium earnings.It also eliminates conditions restricting people from accessing health insurance.

The Affordable Care Act requires all US citizens to purchase health insurance or pay tax penalties.

Nonadmitted and reinsurance reform actThe NRRA ensures that all prospective policyholders are charged equally per risk.Data security model actThis regulation aims to protect the data of consumers collected by insurers. It mandates that insurers take steps to prevent cyber theft.

This list is not an exhaustive one. Also, you should consult with legal professionals about the niche-specific regulations in your preferred sector. For example, life insurance and health care insurance startups must comply with HIPAA.

InsurTech Regulations in the UK

InsurTech Regulations in the UK

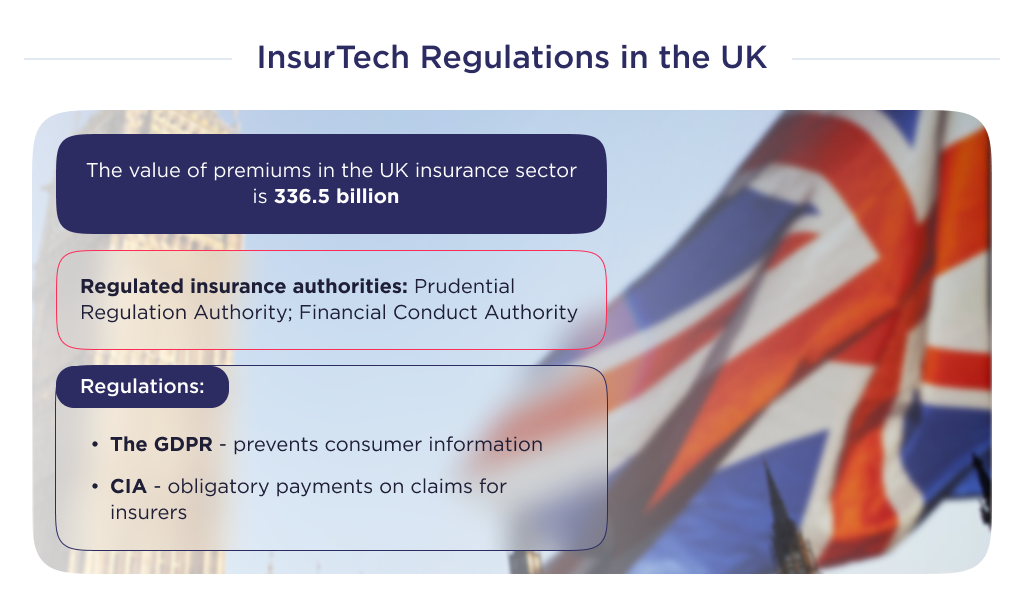

Like the US, there are numerous UK regulators. This is partly because the value of premiums from the UK insurance sector is about $336.5 billion, making it the largest in Europe.

To ensure a stable market, the UK government established some agencies for oversight. Examples are

- Prudential Regulation Authority (PRA): The PRA sets policies that insurtech startups are expected to meet. It assesses when insurance companies are safe, and if they offer appropriate protection to policyholders.

- Financial Conduct Authority (FCA): The objective of this regulator is to ensure that insurance companies function properly and that consumers’ interests are protected. It also regulates competition amongst insurers within its jurisdiction. The FCA has a regulatory sandbox that helps it detect flaws in insurance companies.

Here are some insurance regulations these agencies enforce:

Regulation Meaning General data protection regulationThe GDPR ensures that insurance companies take care of consumers’ information.It restricts consumer-averse technological innovations.

It also ensures that coverage plans are the same per risk.

Financial services act 2012This act aims to ensure insurers adopt consumer-friendly business models.It also prevents anti-competitive practices among UK-based insurance companies.

This act also established the FCA and PRA.

Consumer Insurance ActThis consumer protection act mandates insurers to make claim payments at all times even when consumers unknowingly disclose the wrong information.

Insurtech Regulations in Western Europe

Insurtech Regulations in Western Europe

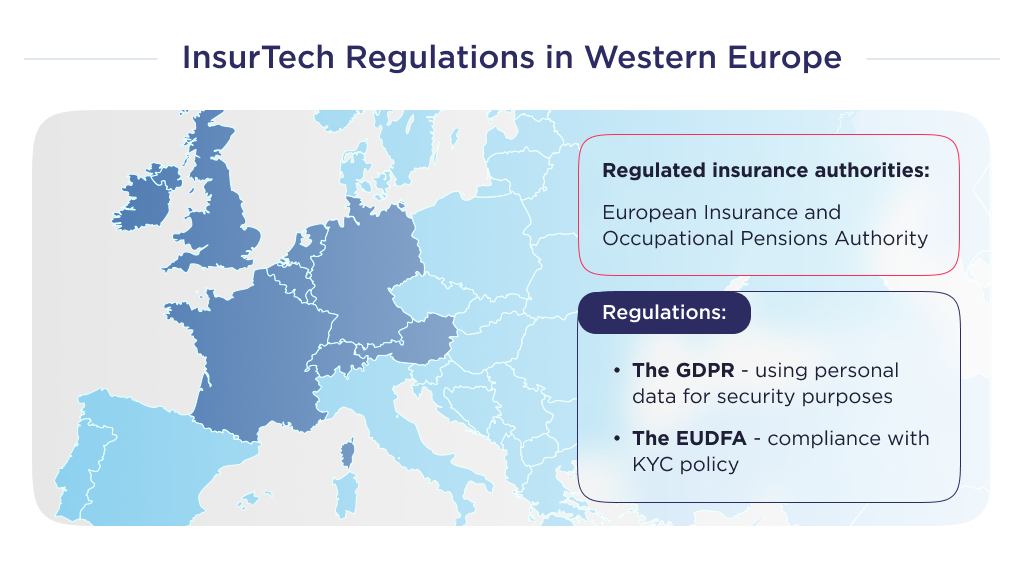

Most regulations guiding western Europe’s insurance market are created by national regulators. Insurtech is regulated by European Insurance and Occupational Pensions Authority on a regional scale.

Amongst the few regulatory acts in western Europe are:

RegulationMeaningThe General Data Protection RegulationThis law aims to restrict how insurance companies handle data by ensuring they only use personal data for insurance purposes.It ensures that big data collected via Artificial Intelligence and machine learning remain safe.

It allows the government to monitor data collection algorithms, and data analytics of insurers if it deems fit.

The European Union Directives and Financial ActionThis directive enforces insurance firms to uphold KYC policies.

For more detailed information on regulations in western Europe, pay attention to regulations by national agencies in your country of operation.

Insurtech Regulations in Australia

Insurtech Regulations in Australia

The traditional insurance services in Australia are valued at $156bn Aud. This makes it one of the largest insurance markets in the world. To operate here, you’ll be regulated by some regulatory agencies, some of which are APRA and ASIC.

Below is more information about these two regulatory agencies:

- Australian Prudential Regulation Authority: APRA monitors companies in the insurance business to ensure consumers are protected. It also vets new products and partnerships before they enter the market.

- Australian Securities and Investments Commission: This agency ensures insurance firms don’t engage in illegal practices. They also protect investors, consumers, and creditors, and investigate fraudulent filings.

The laws regulated by these agencies are:

Regulation MeaningInsurance act 1973This regulation set the minimum amount required for companies that want to operate in the insurance market.Insurance contract act 1984This act ensures that there’s a fair balance between insurers’ and policyholders’ interests.Corporations act 2001 It is the principal legislation that regulates business operations in Australia.It makes and enforces direction on the formation and operation of companies, fundraising, and takeovers.

Note: Australia has lots of state insurance regulators. As such, ensure you find out about requisite laws in your state before launch.

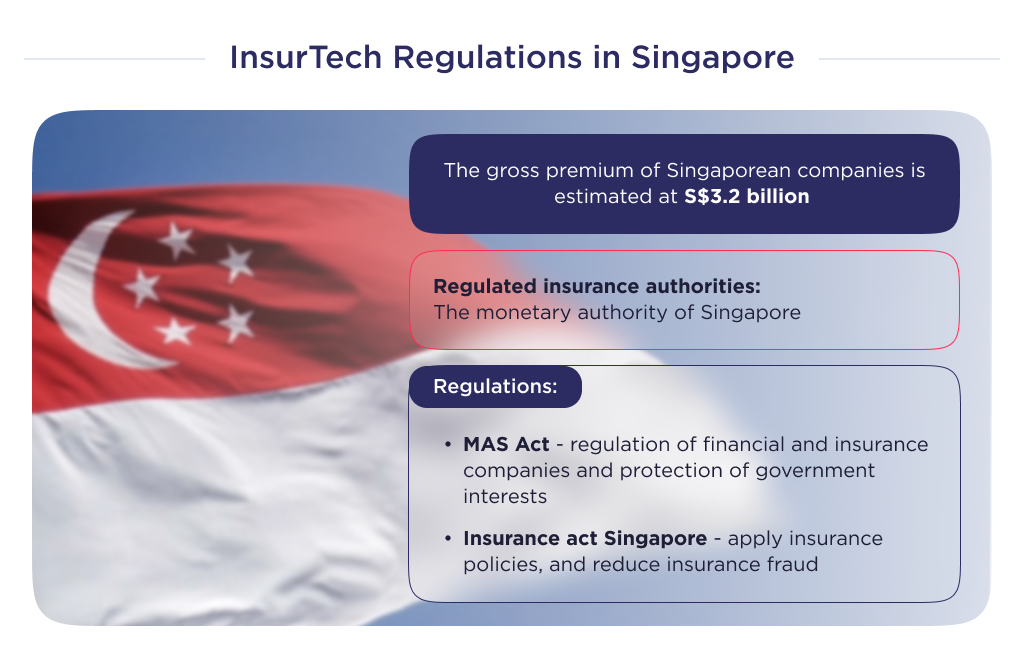

Insurtech Regulations in Singapore

Insurtech Regulations in Singapore

According to Statistica, the gross premium by Singaporean companies is estimated at 3.2 billion Singaporean dollars. For a nation with just 5.7 million people, this is a huge valuation.

To operate here as an insurance startup, you’ll be supervised by a task force, namely, the monetary authority of Singapore. Regulatory requirements in Singapore are:

Regulation MeaningMAS ActThis act regulates all financial and insurance companies in Singapore.It protects the interest of the government and allows MAS to prosecute insurance firms.

Insurance act SingaporeThis act ensures that insurance companies in Singapore are fair to policyholders. It permits the government to enforce insurance policies.The regulation also ensures that insurers properly safeguard data obtained for policyholders. It also aids insurance fraud mitigation.

These insurance compliance requirements are overwhelming. As such, you’ll need guidance on how to comply with insurance laws. Below are ways to adhere to regulations.

These insurance compliance requirements are overwhelming. As such, you’ll need guidance on how to comply with insurance laws. Below are ways to adhere to regulations.

How to Deal with InsurTech Regulation as a Startup?

New startups in this sector can find the policies confusing if they’re aiming at operating in many nations. The best way to handle this challenge is by hiring a regulatory team. Let’s help you with how to hire one.

How to Hire a Compliance Team

You can either hire a compliance team or outsource your operations. Here’s what both options mean.

Hire a Compliance Professional

This method entails hiring a professional from the labor market as your organization’s employee. The staff will work for your startup, while you cater for their monthly wages.

This option is great for companies handling high data volume. Here are its pros and cons:

- ProsConsThe professionals have a detailed understanding of your startup.

- The professional is more loyal to your startup.

- You’ll have to continually make payments, even during sick days. Or other days they’re unproductive.

An alternative is to outsource to a company with expertise in regulatory laws. Let’s discuss this:

An alternative is to outsource to a company with expertise in regulatory laws. Let’s discuss this:

Outsource your Compliance Responsibilities

Hiring a compliance expert can be difficult for a startup. However, an easy way out is outsourcing.

Outsourcing entails hiring another company to handle your compliance responsibilities. This way, your in-house team can focus on improving the customer experience for your product. But as beneficial as it seems, it has its cons. Let’s touch on this briefly:

- Pros Cons There’s an opportunity to sign a contract on an on-demand basis. This means you’ll save money on continuous payment when you don’t need the service.

- The compliance team still has to understand your startup.

- They may work for competitors.

- They may suddenly stop working for your startup if a higher paying client comes or based on their initiative.

Now that you know much about insurtech compliance, what else? There’s more to learn about insurance technology.

Now that you know much about insurtech compliance, what else? There’s more to learn about insurance technology.

Interested in Having a Better Understanding of Insurtech?

Beyond insurtech regulatory compliance, having a successful insurance company entails having viable insurance ideas. You can learn this and more by reading our article titled insurance app ideas. It consists of all you should know about being successful in this niche.