The world of finance is transforming, thanks to the rise of decentralized technologies and blockchain. Decentralization is not limited to just cryptocurrencies; it extends to various aspects of finance, including investment management and hedge funds. In this article, we will delve into the concepts of Decentralized Investment Management and Dispersed Investment Funds, highlighting their key features and potential benefits.

Dispersed Investment Administration:

Traditional investment management typically involves intermediaries such as banks, asset managers, and brokers who control and execute investment decisions on behalf of clients. Decentralized Investment Management, on the other hand, aims to eliminate these intermediaries and give investors more direct control over their assets. This is made possible through blockchain technology, which enables smart contracts and decentralized applications (dApps) to manage investments.

Key Features of Dispersed Investment Administration:

1. Transparency: Blockchain technology ensures transparency by recording all transactions on a public ledger. Investors can verify their investments and the performance of their chosen assets in real time.

2. Security: Assets held within a Dispersed Investment Administration system are safeguarded by cryptographic principles. This reduces the risk of fraud and unauthorized access.

3. Reduced Costs: By eliminating intermediaries, Dispersed Investment Administration can significantly reduce fees, increasing the overall returns for investors.

4. Accessibility: Anyone with an internet connection can access decentralized investment platforms, making them accessible to a global audience.

5. Autonomy: Investors retain complete control over their assets and investment decisions, reducing reliance on third parties.

Dispersed Investment Funds:

Hedge funds have long been associated with high fees, limited access, and opaque operations. Decentralized Hedge Funds seek to address these issues by leveraging blockchain technology and smart contracts to create transparent and open investment vehicles.

Key Features of Dispersed Investment Funds:

1. Tokenization: Dispersed Investment Funds often represent ownership through tokens on a blockchain. These tokens can be easily traded and provide liquidity to investors.

2. Smart Contracts: Smart contracts automate the execution of investment strategies, ensuring that fund managers follow predefined rules and investors' interests are protected.

3. Transparency: All transactions and holdings are recorded on a public blockchain, allowing investors to track fund performance in real time.

4. Lower Fees: Dispersed Investment Funds typically have lower management fees and performance fees compared to traditional hedge funds.

5. Global Access: Investors from around the world can participate in Dispersed Investment Funds, breaking down geographical barriers.

Empowering Investors through Decentralized Investment Management and Hedge Funds:

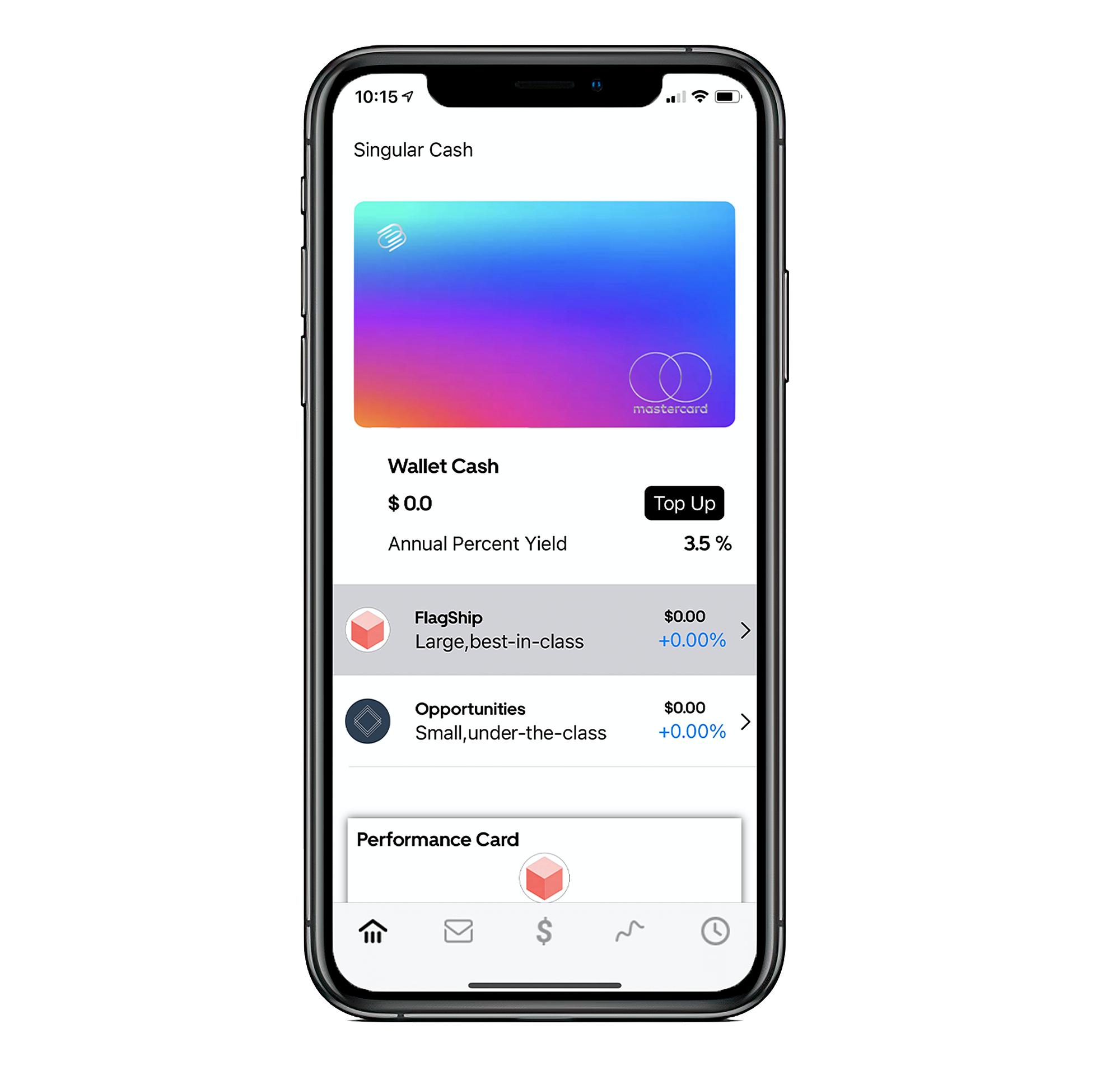

In this era of decentralized finance (DeFi), This Company has been making waves in the world of Dispersed Investment Administration and the Decentralized Hedge Fund. This organization is at the forefront of combining blockchain technology and financial expertise to offer a new paradigm in investment management.

This platform empowers investors by providing them with a range of decentralized investment options. Through their platform, investors can create customized portfolios, access Dispersed Investment Funds, and take advantage of various DeFi protocols - all while maintaining complete control of their assets.

Conclusion:

Dispersed Investment Administration and Dispersed Investment Funds represent a promising evolution in the world of finance. With the elimination of intermediaries, increased transparency, and reduced costs, these innovations empower investors to take control of their financial futures. singularvest, as a leading player in this field, exemplifies the potential of blockchain technology to revolutionize traditional investment practices. As the world continues to embrace decentralized finance, the future of investment management and hedge funds looks brighter than ever.

Blog Source URL:

https://singularvest.blogspot.com/2023/11/exploring-dispersed-investment.html