Corrugated Board Cost and Pricing Analysis

In this corrugated board procurement intelligence report, we have estimated the pricing of the key cost components. Kraft Paper, Labor, and corn starch form the largest cost component of this category. Kraft paper holds the majority of the cost. Post Covid-19 pandemic recovery, the disrupted supply chain has surged the energy costs and freight costs globally, which has decreased the demand globally resulting in a 5% decrease in the export from the year 2020. Despite less export, the value increased in terms of supplies to reach USD 3.6 billion surging 16%. This is due to the rise in the average export price by 23% to reach USD 1,882 per tonne. Kraft paper which is the principal material in making corrugated board has seen a surge of 25% in the price during the initial month of 2022. European region exported the cheapest wastepaper material used in the category, and with the ban on export from the region, the prices started jumping off.

Freight cost has a lot of impact in judging the price in the category. Amid the Pandemic recovery, logistics costs reached USD 3600 per 40 feet container, just double the usual cost involved. This resulted in a decline in the import of cheaper raw materials from LCC countries, resulting in higher prices of the category. The pricing also depends upon the type of flute type used such as A, B, C, E, F type, and others. The usual corrugated board-making machine costs around USD 20,000 - 50,000, but 3,5,7 ply costs around USD 70,000 - 80,000. Production made using different categories of machines has an impact on the prices of the category.

Order your copy of the Corrugated Board category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Operational Capabilities - Corrugated Board

Industries Served - 22%

Geographic Service Provision - 17%

Certification - 16%

Years in Service - 15%

Employee Strength - 10%

Revenue Generated - 10%

Key Clients - 10%

Functional Capabilities - Corrugated Board

By type:

Single Face - 25%

Single Wall - 25%

Double Wall - 25%

Triple Wall - 25%

Rate Benchmarking

The geographical location, scale, and type of materials used during manufacturing play a vital factor in analyzing the rate benchmarking of the corrugated board category. For example, board services in China are typically cheaper than services in other parts of the world. This is due to the wide availability of Kraft papers in the country and the latest technology used for subsequent packaging has broadened the market reach for them. China exports around USD 158 million of Kraft papers around to South Korea, Vietnam, Australia, and Malaysia. Machines used for production are also cheaper ranging from semi-automatic to fully automatic machines of different ply involved ranging from starting price of USD 20,000 to 80,000. The wide availability of raw materials and cheap labor to run operations has allowed it to lead in the market.

List of Key Suppliers

- DS Smith

- Smurfit Kappa

- WestRock Company

- Mondi

- Packaging Corporation of America

- Stora Enso

- International Paper

- Georgia-Pacific

- Oji Holdings Corporation

- Port Townsend Paper Company

Supplier Newsletter

- In September 2021, Mondi Group expanded its production line in Szczecin, Poland. This expansion plan is to streamline their packaging process for the e-commerce industry and help them in establishing themselves as a leader in the European market for the industry.

- In July 2022, Georgia-based Company WestRock, which is the leading manufacturer of packaging and containerboard products in the U.S., entered into a strategic agreement to acquire Mexico-based Company Grupo Gondi for USD 970 million. This strategic acquisition will help in enhancing its position in the packaging materials market.

- In September 2021, Heinz, a food processing company, entered into a strategic partnership with WestRock Company for developing a replacement for shrink-wrapped multipacks with recyclable paperboard. These are renewable, recyclable, responsibly sourced carbon-neutral paperboard sleeves designed for sustainable packaging solutions.

- In 2022, Westrock Co., the U.S.-based manufacturer of packaging and containerboard acquired a leftover interest in GRUPO Gondi. GRUPO Gondi has multiple businesses throughout Mexico including corrugated plants, graphic plants, and paper mills. After the acquisition, Westrock Co. expanded its operations to Latin American markets.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Office Supplies Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Media Buying and Planning Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Corrugated Board Procurement Intelligence Report Scope

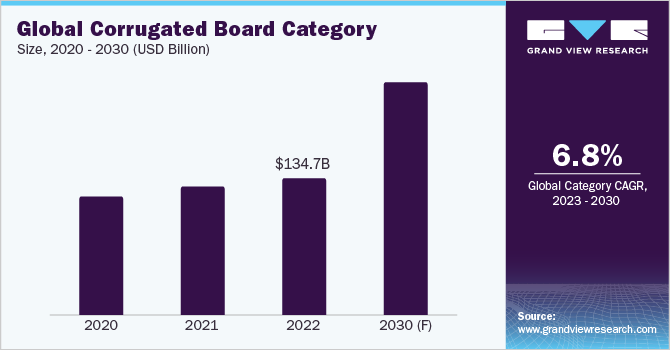

- Corrugated Board Category Growth Rate : CAGR of 6.8% from 2023 to 2030

- Pricing Growth Outlook : 20% - 25% (Annually)

- Pricing Models : Cost plus pricing model, and market-based pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : By type, operating capability, quality measures, technology, certifications, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions