Courier, Express, and Parcel Services Cost and Pricing Analysis

In this courier, express, and parcel services intelligence report, we have estimated the pricing of the key cost components. This category encompasses several major cost components in courier, express, and parcel services. These components include fuel costs, labor costs, vehicle costs, insurance costs, and administrative costs. Due to the frequent long-distance travel of couriers and delivery vehicles, plus the fact that fuel prices might vary by location, fuel costs make up 25% of the whole cost. Due to the industry's reliance on drivers to offer the services, labor expenditures make up 30% of total costs. 20% of expenses are related to vehicles because couriers and delivery drivers need to use them to deliver the goods, and the price of a fleet of vehicles depends on its size and type. As companies insure the drivers as well as high value products which can be used during any untoward incidents, insurance expenses account for 15% of the total, and administrative costs account for 10%, as they must accomplish functions like billing, customer support, and marketing.

Courier costs vary depending on factors like distance, weight, package size, delivery time, security needs, and season. In densely populated urban areas, courier services are more competitive, while rural or underdeveloped areas may have higher costs. Regional variations range from USD10 to USD30 for domestic services in the US to USD50 to USD150 for overseas shipments. European countries like Germany offer reasonable shipping prices, while logistical difficulties in Asia may cause costs to vary.

Order your copy of the Courier, Express, and Parcel Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Operational Capabilities - Courier, Express, and Parcel Services

Geographic Service Provision - 30%

Industries Served - 20%

Years in Service - 15%

Revenue Generated - 15%

Employee Strength - 12%

Certification - 8%

Functional Capabilities - Courier, Express, and Parcel Services

Pickup and Delivery - 28%

Package Handling - 22%

Tracking and Tracing - 20%

Customer Service - 10%

Insurance - 10%

Logistics Support - 10%

Rate Benchmarking

Rate benchmarking plays a crucial role in the highly competitive courier, express, and parcel (cep) industry. It involves a comprehensive process of meticulously comparing the rates charged by different CEP providers for their services to establish industry standards and identify potential outliers. The CEP market is characterized by its diverse range of factors that influence pricing, such as shipment distance, weight, size, delivery speed, and even seasonal fluctuations. For instance,

- A 10-pound DHL shipment from New York City to Los Angeles, with a speedy two-day delivery requirement, may come with a price tag of USD 25. However, by opting for a slightly longer delivery timeframe of three days, the cost could reduce to just USD 15 for the same shipment.

- It can cost CNY 30 to send a 10-pound package with SF Express from Beijing to Shanghai with a strict 24-hour delivery deadline. However, if a delivery window of 48 hours is chosen, the price might drop to just CNY 20 for the identical package.

This dynamic pricing structure highlights the importance of rate benchmarking to help businesses and consumers make informed decisions and navigate the often-complex web of pricing options. By analyzing the rates of various CEP providers, companies can gain valuable insights into prevailing market trends, competitive pricing strategies, and areas where potential cost optimizations can be made. Ultimately, rate benchmarking empowers stakeholders in the CEP industry to make more informed choices and maintain a competitive edge in the market.

List of Key Suppliers

- A1 Express Delivery Service Inc

- Aramex International LLC

- Deutsche Post DHL Group

- DTDC Express Ltd

- FedEx Corp.

- SF Express (Group) Co. Ltd

- Poste Italiane SpA

- Qantas Courier Limited

- United Parcel Service Inc.

- SG Holdings Co. Ltd.

Supplier Newsletter

- In November 2022, DHL Supply Chain, a global transportation provider, announced the development of a carbon-neutral real estate portfolio of 400,000 square meters. The portfolio is designed to support the growth requirements of DHL's customers across major 6 tier 1 cities as well as meet company's sustainable goals.

- In June 2022, Access USA Shipping LLC (MyUS), a technology-driven platform facilitating cross-border e-commerce, was acquired by Aramex PJSC, a prominent global provider of integrated logistics and transportation solutions. This deal will help Aramex to strengthen its cross-border e-commerce offerings.

- In 2022, UPS partnered with Zipline, a startup focusing on medical drone delivery, to deliver blood to remote areas of Rwanda. The initiative was a success, with Zipline delivering over 11,000 units of blood in the first year. The partnership has opened up opportunities for more similar ventures in Africa and rural areas.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Office Supplies Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Media Buying and Planning Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Courier, Express, and Parcel Services Procurement Intelligence Report Scope

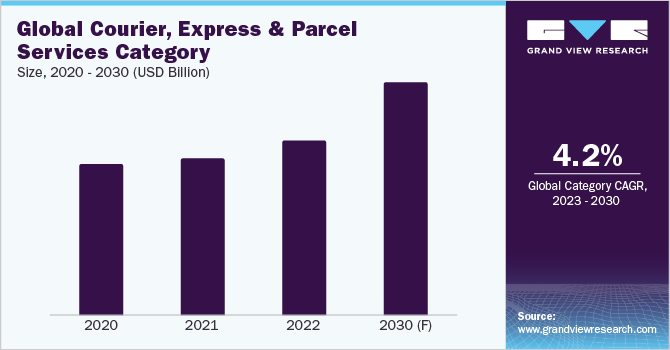

- Courier, Express, and Parcel Services Category Growth Rate : CAGR of 4.2% from 2023 to 2030

- Pricing Growth Outlook : 3% - 4% (Annually)

- Pricing Models : Value-based pricing, volume-based pricing

- Supplier Selection Scope : Cost and pricing, past engagements, geographical presence

- Supplier Selection Criteria : Pricing, network, technology, customer service, flexibility, and security

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions