Insurance Services Cost and Pricing Analysis

The pricing and cost analysis helps in deriving and forecasting the actual cost of products or services over the forecast period. It considers all the cost components and provides a competitive edge during supplier negotiations. Moreover, the outcome helps procurement leaders understand detailed and fact-based cost drivers for the category.

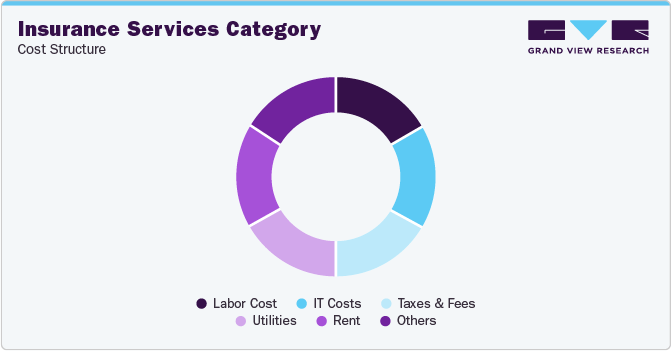

In this insurance service procurement intelligence report, we have estimated the pricing of the key cost components. Labor costs, IT costs, taxes & fees, utilities, rent, and others are some of the key cost components of the category. The cost of insurance services can vary based on the type of insurance, business complexity, location, and various other aspects. IT costs such as software maintenance, upgradation, and technical support along with legal charges account for a major part of the cost component. Digitization of the insurance process can reduce the processing cost by 40 - 50%, and processing time by 50 - 90% which would result in improved customer service.

In 2022, the average price of individual health insurance in the U.S. was USD 560 per month for a 40-year-old. Similarly, the average price of full coverage car insurance can cost USD 1,780 per year. In 2022, China’s average health insurance premiums for individuals were around USD 5,274, and for family, premiums were around USD 16,241.

Order your copy of the Insurance Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Operational Capabilities - Insurance Services

Industry Served - 20%

Revenue Generated - 15%

Employee Strength - 15%

Geographical Service Provisions - 15%

Years in Service - 15%

Key Clients - 10%

Certifications - 10%

Functional Capabilities - Insurance Services

Risk Assessment & Underwriting - 20%

Claims Handling - 20%

Product Innovation - 20%

Customer Services - 20%

Others - 20%

Rate Benchmarking

When analyzing rate benchmarking of insurance services, location plays an important role, as regulations related to insurance change depending on the locality. For instance, in the U.S., healthcare spending is higher as compared to spending in Switzerland. In 2022, the U.S., spent around USD 12,555 per person on healthcare. On the other hand, Switzerland stood in second position spending around USD 8,049 in healthcare costs. With the rising healthcare issues in Switzerland, people are focusing on covering the risk through insurance. This is anticipated to drive the demand for the category.

According to IBEF, Life insurance firms in India collected 18% more premiums in 2023 as compared to the previous year. Private insurers in the country face tough competition in providing different services in life as well as non-life insurance.

According to Insurance Business 2023 report, the Philippines saw a rise in reinsurance rate by 50% due to natural calamities because of climate change. However, due to low labor costs, the Philippines is the best-sourcing country for the category, due to low premium rates.

List of Key Suppliers

- Allianz

- Manulife

- Cigna

- Humana

- AXA Insurance Company

- MetLife

- Zurich Insurance Company

- State Farm

- Nippon Life Insurance Company

- Generali Group

Supplier Newsletter

- In August 2023, NH Nonghyup Life Insurance signed an agreement to partner with iCOOP Co Ltd., with an aim to offer innovative digital health management services. Considering their alliance, NH Nonghyup Life Insurance and iCOOP will work together closely, aiming to create inventive business models and strategies.

- In August 2023, Hartly Insurance Services, LLC partnered with King Insurance Partners which is a full-service insurance brokerage firm. Hartly presents best-in-class insurance companies to B2B customers.

- In November 2022, Chubb introduced a new feature in its integration platform Chubb Studio, which can integrate offerings from Chubb as well as 3rd party insurance carriers into their digital ecosystems.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Office Supplies Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Media Buying and Planning Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Insurance Services Procurement Intelligence Report Scope

- Insurance Services Category Growth Rate : CAGR of 9.0% from 2023 to 2030

- Pricing Growth Outlook : 2% - 3% (Annually)

- Pricing Models : Insurance type-based pricing, service-based pricing, competition-based pricing

- Supplier Selection Scope : Types of insurance, coverage options, end-to-end service, customization, cost and pricing, compliance, service reliability, and scalability

- Supplier Selection Criteria : Types of insurance offered, policyholder information transparency, claims handled by the supplier, claim processing time, coverage options offered, global reach, customization option, services offered, track record and reputation, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions