China Business Process Outsourcing Market Growth & Trends

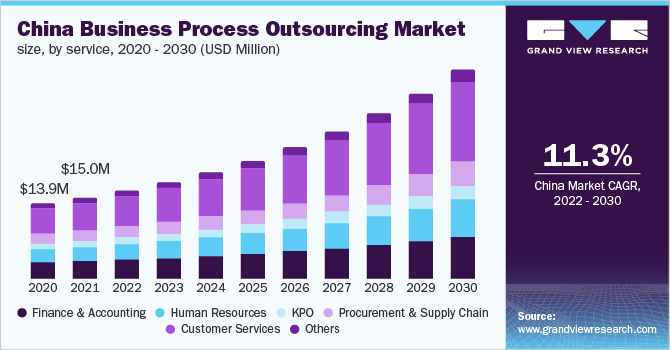

The China business process outsourcing market size is projected to reach USD 38.38 billion by 2030, growing at a CAGR of 11.3% during the forecast period, according to a study conducted by Grand View Research, Inc. The market has been driven by several factors including international trade agreement, an increase in job opportunities by providing BPO-specific education to graduates, and the growing demand for outsourcing in BFSI, IT & telecommunication, and human resource domains. Despite the lack of English proficiency in China, the country has developed strong educational reforms to create millions of outsourcing jobs. Investments by educational institutions to train students for the BPO industry have provided growth opportunities.

China Business Process Outsourcing Market Segmentation

Grand View Research has segmented the China business process outsourcing market on the basis of service and end use:

Based on the Service Insights, the market is segmented into Finance & Accounting, Human Resources, Knowledge Process Outsourcing (KPO), Procurement & Supply Chain, Customer Services, Others.

- The customer services segment dominated the market in 2021 with the largest revenue share of 32.95%, and this is credited to a substantial change in consumer behavior regarding purchasing & payments and increased demand for enhanced customer experience. The customer service centers/call centers in China are majorly located in the South, North, and Eastern regions. However, outsourcing companies are seeking to move towards Central and Southwest China to envisage even reducing operational costs for business operations in the near future.

- Furthermore, the finance and accounting segment is expected to witness significant growth during the forecast period. This growth can be attributed to the stringent regulatory requirements and strong presence of banking facilities in Western European countries, notably due to GDPR in the banking sector, resulting in the need for outsourcing services, as outsourcing permits a significant reduction in operating costs. Moreover, the human resource BPO services are also anticipated to grow substantially at a significant CAGR during the forecast period. This growth can be ascribed to the rising need for resources across different sub-segments, such as payment processing, administration, and recruitment & relocation.

Based on the End-use Insights, the market is segmented into Banking, Financial Services & Insurance (BFSI), Healthcare, Manufacturing, IT & Telecommunication, Retail, Others.

- The IT and telecommunications segment dominated the overall market with a share of 35.21% in 2021 and is expected to grow at a significant CAGR during the forecast period. Telecom companies are adopting telecommunications outsourcing to reduce the overall Capital Expenditure (CAPEX). The telcos outsource various business functions, from call center outsourcing to billing operations to finance and accounting outsourcing. Outsourcing solutions help telecom companies to establish a flexible strategy to acquire and retain more customers, access specialized resources, optimize current investments, and manage cost pressures. The BFSI segment is likely to grow at the fastest CAGR during the forecast period.

- Several domains in the BFSI industry, including asset management and investment management, are opting for specific outsourcing processes and are including it as a part of their business models. BPO services offer greater cost efficiency, increased flexibility, enhanced service quality, and new adapted solutions to solve the challenges that are encountered by the industry. Moreover, the healthcare sector in China has witnessed a significant rise in technology spending as the country focuses on improving its advanced patient care systems. The trend is expected to remain strong in the near future and IT services, such as healthcare information systems, data center services, and logistics & supply chain, are likely to attract more investments and outsourcing deals in the country.

Market Share Insights

- June 2021: Chinasoft International Co., Ltd. signed an agreement with Microlink Solutions Berhad to develop joint Information & Communications Technology (ICT). This partnership intends to expand Chinasoft International's global footprint in the Asian market.

Key Companies Profile & Market Share Insights

The market is fragmented and is characterized by extreme competition amongst the market players. Key players are focusing on strengthening their hold in the market by implementing strategies, such as partnerships, agreements, joint-ventures, geographical expansion, and mergers & acquisitions.

Some of the prominent players operating in the China business process outsourcing market include,

- Accenture Plc

- Amdocs Ltd.

- Capgemini SE

- China Customer Relations Centers, Inc.

- China Data Group Co., Ltd.

- Chinasoft International Co., Ltd.

- Infosys Limited (Infosys BPM)

- M&Y Global Services

- Northking Information Technology Co., Ltd.

- Wipro Ltd.

Order a free sample PDF of the China Business Process Outsourcing Market Intelligence Study, published by Grand View Research.