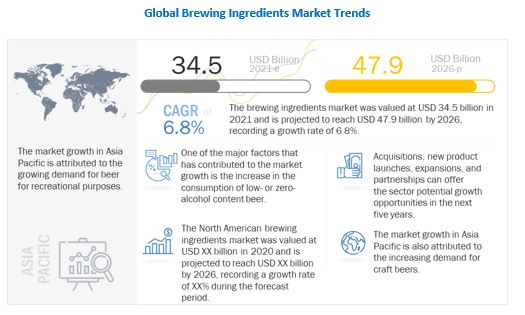

The brewing ingredients market is projected to grow at a CAGR of 6.8% to reach USD 47.9 billion by 2026. It was estimated at USD 34.5 billion in 2021. The rise in demand for beers from all over the globe, coupled with increasing consumption of craft beers, will drive market demand and the growth of brewing ingredients globally.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

Increasing demand for low- or zero-alcohol content beer

With changing lifestyles, there is an increase in health awareness. This awareness has created a demand for healthier products in the food and beverage industry. Due to this, the demand for beer with a low alcohol content is increasing. According to the ADM survey, in 2020, a total of 51% of consumers will be looking for items that contribute to their metabolic health and promote a healthy weight. Low-alcohol products are no longer considered inferior ones. On the other hand, these products are more in demand, as they offer the taste and experience of alcohol minus the guilt. Consumers are looking for beers with high protein and other nutritious content and reduced carb, sugar, and alcohol content.

Opportunity: Introduction of new flavors in beer

The increase in beverage consumption has led to intense competition amongst beer brands, resulting in the introduction of new flavors and increasing beer consumption. There is a growing popularity for craft beers as it offer various flavors besides the regular flavors offered by macrobreweries. The introduction of new ingredients and innovative flavors, combining salty, fruity, and tart flavors, by craft beers, has found an increasing appeal among the millennial crowd globally. Some of the macrobrewers are also acting on to respond to these changing demands from consumers. For example, Heineken USA, in 2021, launched Dos Equis Lime Salt variety pack of lager beer. Similarly, Latambarcem Brewery (India), in 2020, launched a new craft beer brand called Maka di that currently serves four brews: Honey Ale, Belgian Tripel, Bavarian Keller, and Belgian Blanche. The introduction of these new flavors is projected to increase the sales and consumption of beer. Thus, this is anticipated to provide ample opportunities to players operating in the global market.

By source, the malt extract segment is estimated to hold the largest share in the brewing ingredients market

The market includes five major sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives. The malt extract segment is further bifurcated into standard malt and specialty malts. Brewing-grade malt extracts are made with the highest-quality brewing malts and get additional colors and flavors from using specialty malts. This gives beer the unique character and flavor desired for the particular style brew. These malts often have a longer time in the kiln, at higher temperatures, or get roasted to add depth, complexity, and flavor to the resulting beer. Specialty malts include less in the way of sugars but have a greater influence on the color of the beer. These malts are widely used in craft beers.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=248523644

The increasing demand for beers in the Asia Pacific countries drives the region's growth rate at a higher pace.

The Asia Pacific region comprises two high-growth economies: India and China. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Hence, beer produced in macro breweries and craft breweries still has a high-growth rate. Moreover, the increasing spending capacity of consumers has led to a surge in demand for craft beers. There has been an emergence of various craft breweries in countries such as India over the last few years.

The key players in this market include Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). These players in this market are focusing on increasing their presence through new product launches and expansions. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.