You could be the most carefree person on this planet, but the moment you become a parent - your whole world will shrink down to that little bundle of joy. Every goal you’ve had, every ambition ever aspired for, will now include the stability and security of your child’s future as an integral part.

Being a parent is rewarding in a million possible ways. However, being a parent also means a lot of sleepless nights, extensive financial vigilance, and a keen eye when it comes to savings and investment plans. After all, the first step towards securing your child’s future is providing them with proper education and financial stability.

This often leads to a whole lot of brainstorming, which results in you revisiting and revising most of your existing monetary plans. All of this can either be a productive step towards a better future for you and your family or a colossal waste of time.

In the end, it all comes down to the direction your efforts are focussed in and the steps you actually end up taking. When it comes to investing your savings, Mutual Funds is one of the best options available today. This becomes even more relevant in the case of long term financial plans like saving up for a child’s future needs.

Every long term saving plan requires careful planning and consideration of the unavoidable inflation rate. You can’t just take into account the current market conditions but also need to prepare efficiently for the inevitable inflation which could adversely impact your savings.

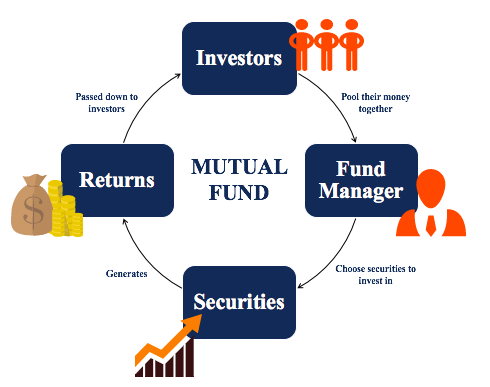

Mutual Funds

Mutual funds serve as a stable investment tool even in the presence of ever-volatile market forces. You can be assured of guaranteed returns over a long period of time. This makes it one of the safest options when it comes to saving up for your child’s future needs.

With the cost of education skyrocketing with each passing day, investment of your savings is the only way to secure your child’s college and higher education funds without running yourself into the ground or piling up insurmountable student loans. But, you need to be very careful with the investments you opt for.

Where To Invest?

Choosing the right fund to invest in requires a thorough consideration of various factors, which include:

- Your Budget

Having unrealistic financial goals can lead to massive investment failures. Thus, instead of selecting a random figure just because it sounds good, you should carefully chart out your entire budget for the duration of your investment tenure.

When saving for a child’s higher education, the smart way to go about things is to take into account the current cost of courses - from school fees to college admissions, followed by market research to determine the possible inflation rate in the future. Adding these up and rounding them off to the nearest feasible amount should do the trick.

The amount thus derived should serve as your target budget, and all your investment policies and efforts should be aligned to the same.

- Tenure Of Investment

Depending on your financial goals, you need to consider the time for which you will be willing to invest your savings. Some funds are intended to reap fruits over a shorter period of time, whereas some require a larger time bracket to yield substantial profits.

When it comes to saving for your children, it goes without saying that time is usually on your side. Most parents start saving for their kids at a very early age which means that the fund you choose to invest in also needs to align with this goal.

That being said, often impatient investors withdraw their investments in light of rocky market conditions and miss out on the long term benefits of their investments based on temporary market fluctuations.

When it comes to saving for your kids, it is essential for you to develop patience and stay firm with your investment term because in the long run, the finicky market movements will have minimal effect on your investment and inevitably on your child’s financial future.

- Separate Emotion From The Equation

When it comes to our loved ones, especially our children, our decisions are often guided by emotions instead of practicality. This simple fact is often exploited by various financial companies selling shady and ineffective benefits in the name of “Children’s Mutual Funds”.

Before investing in any self-proclaimed “Children’s Scheme”, it is vital to read the fine print. Go through the conditions applicable, along with the risks involved. Also consider the protection offered against the inevitable inflation down the line.

Another impulsive decision parents are often prone to take is withdrawing their investments in the face of volatile market conditions before their term ends. This happens because they get worried about not having sufficient savings or not fulfilling their pre-decided financial goals in time. However, such reckless moves are more harmful than helping.

It is better to invest in Children funds that come with a lockdown clause which can help prevent any reckless behavior on the parents’ part and thus, serve the needs of the children better. These fundamental factors should help you decide the best investment policy when it comes to securing a bright future for your precious little darlings!