The GSTR-8 return form is monthly returned to be filed by e-commerce companies. E-commerce companies are mandatorily registered under GST and required to deduct TCS (Tax Collected at Source) under GST.

Form GSTR-8 showcases the details of supplies made by E-commerce platform to the registered, unregistered customer, tax paid, and tax payable along with the amount of tax collected at source from sellers.

Important Features of GSTR-8 Return Form

- GSTR-8 is a mandatory form that has to file by every registered E-commerce operator

- It has to be filed on or before 10th of the coming month of a tax period.

- GSTR- 8 contains 8 headings, most of which are auto-populated.

- The details furnished by an e-commerce operator in GSTR-8 is available in part D of GSTR 2A.

- E-commerce portal deducts the Tax collection at source(TCS) from the supplier of the goods and services and returns it to the government

- E-commerce operators pay 1% TCS on all the goods and services sold out via their portal.

Eligibility for E-commerce TCS Deduction Under GST

Central Board of Indirect Taxes and Customs (CBIC) have clarified that entities having aggregate turnover less than INR 20 lakhs (or INR 10 lakhs in case of mentioned special category states) in a specific financial year are free from having mandatory registration.

How GST defines E-commerce Operator?

Section 43B(d) of the Model GST Law defines E-commerce as the platform that let an online market to receive/ supply the goods and services from/ to different vendors and customers respectively. For an e-filing of GSTR-8 via tools like Gen GST software, an e-commerce operator should be registered under GST.

GSTR-8 Eligibility

Every E-commerce operator is eligible to file GSTR-8.

Common Abbreviation Related To GSTR-8

GSTIN: Goods and Services Taxpayer Identification Number

UIN: Unique Identification Number

UQC: Unit Quantity Code

HSN: Harmonised System of Nomenclature

SAC: Services Accounting Code

POS: Place of Supply of Goods and Services

B2B: Business to Business (from a registered person to another registered person)

B2C: Business to Consumer (from a registered person to an unregistered person)

Interest & Penalty on Late or Non-payment of GST

As per the GST norms, each subsequent non-payment of taxes will accrue 18 percent interest on the GST tax payable starting from the due date till the taxes are paid. For the detailed knowledge about it, you can check detailed interest guides in chapter 10, point 50 via below mentioned link: https://cbec-gst.gov.in/CGST-bill-e.html

For Instance: When a taxpayer fails to pay GST within the due dates there the interest will be calculated starting from the due date i.e. 1000*18/100*1/365= Rs. 0.49 per day at approx. ( Tax payment ( assumed) = Rs. 1000, Interest rate per annum= 18%, Time period deferred by the taxpayer = 1 day )

In addition, Late payment of GST attracts a penalty of Rs 100 for CGST and Rs 100 for SGST per day (maximum Rs 5000) as per the GST provisions.

Fully Guided Procedure to File GSTR-8 for TCS Taxpayers

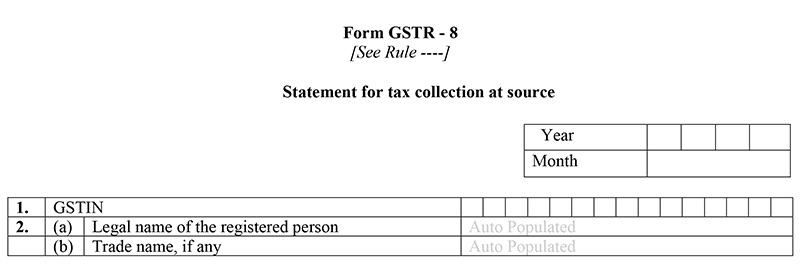

Table 1&2: Details of Taxpayer

- GSTIN: The GSTIN is a 15-digit number that has 2-digit state code,10-digit permanent account number, and 3-digit encompasses state, future use, and check-digit.This field gets auto-populated during the return filing.

- Name of Taxpayer: The field gets auto-populated with the name of a taxpayer during the time of return filing. A separate option to file the Trade Name if applicable is also there.

- Month-Year(Period): The field is filled by the taxpayer by selecting the date and year from drop down for which GSTR-8 is being filed.

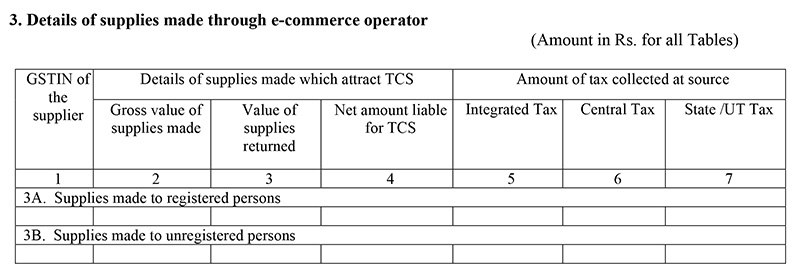

Table 3: Details of supplies

- 3A-Fill the details of supplies made through E-commerce portal to the registered person

This field is for supplies between B2B. Here taxpayer fills the details of the registered supplier who supplies goods and services to registered customers using the portal. It contains GSTIN of the merchant, the gross value of the supply made, the value of supply returned, and net amount reliable to tax - 3B-Fill the details of supplies made through an e-commerce portal to the unregistered person

The supplies made between B2C. It contains all the fields as B2B transaction has such as GSTIN, the value of returned supply, the gross value of supply made, and other taxes.

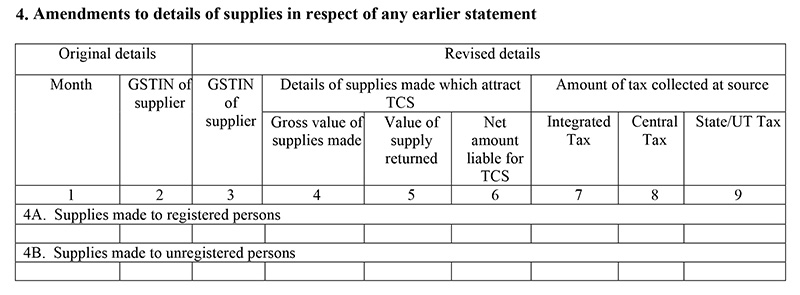

Table 4: Any amendments in supplies made by an e-commerce operator to registered or unregistered person.

4A- amendments in table 3A of GSTR-8

- Amendment in B2B transaction during the last month, the taxpayer can alter the details on e-commerce portal under Section 4A of the GSTR-8

4B- amendments in table 3B of GSTR-8

- Amendment in B2C transaction during the last month can be edited under section 4B of GSTR-8.

Amount of TDS

- The e-commerce operators furnish this head with details about TDS by B2B and B2C transactions. This is an important head which is to be furnished on the basis of supplies made during the month. It constitutes integrated tax, central tax, and state/UT tax as well.

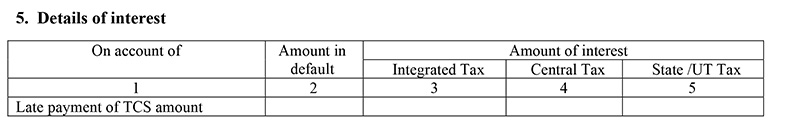

Table 5: Details of Interest

This field is auto-populated by the former headings and compute the TDS, interest on late payment of TCS, and the fee for delayed filing Table 6&7: Interest/Tax Payable and Paid

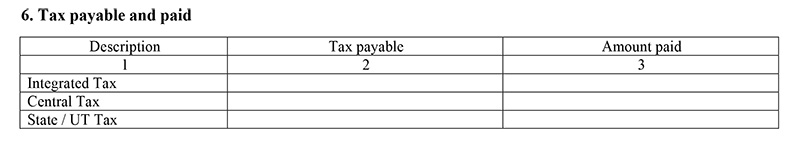

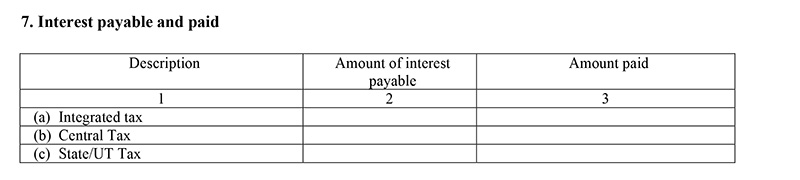

Table 6&7: Interest/Tax Payable and Paid

The head is auto-populated from the former headings and gets furnished with the details about the tax, Interest, and fees paid/payable to the government.

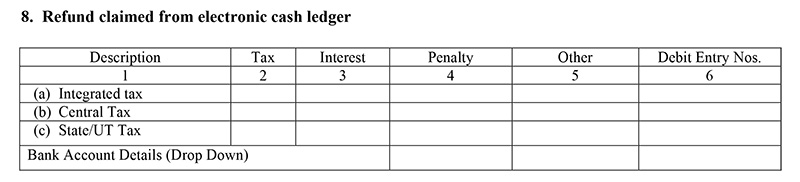

Table 8: Refunds claimed from electronic cash ledger

The head is auto-populated from the former headings and gets furnished with the refund details claimed from bank account details and electronic cash ledger.

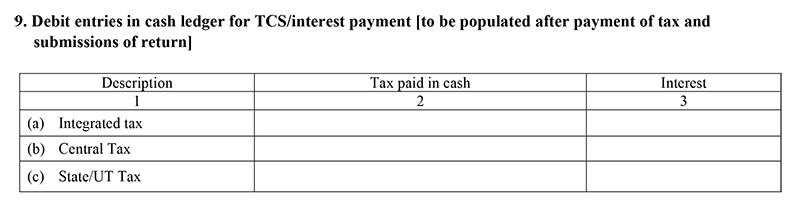

Table 9: Debit entries in cash ledger for TCS/interest payment (auto-populated after the payment of tax and submission of return)

The field gets auto-populated after the payment of returns. It constitutes the tax payment done in cash and interest paid to the taxpayers.

After filling all the details, the taxpayers need to attest the same via digital signature.