The scope of the digital world is changing every day and so is the acceptability of e-wallet app development. Digital payment means the payment for a transaction using digital modes like paying through mobile apps, UPI, IMPS, and others.

Digital wallet apps are usually defined as a digital version of a physical wallet with more functionality. Various apps like Paytm, Freecharge, Venmo, and many more are developed to make it convenient for people to make payments easily without carrying any hard cash.

Security is a major concern in the case of digital payment methods, so it is necessary to secure such payment apps to gain customer trust and loyalty.

How to Secure Digital Wallet Apps Like Venmo?

Payment through digital wallet apps should be secured by a facility of one-time password (OTP), where the customer has to provide the 4-digit pin sent on his registered mobile number to make payment from the wallet. The customer should be made aware of the various frauds and should also be instructed not to provide any personal data or information to any unauthorized person.

A person having any digital wallet app in mobile should secure their screen or app login with a strong password or pin or biometric identification to make it secure. Avoid buying anything over public Wi-Fi and using your data connection is preferred to protect the loss of your financial data.

Always stay alert to any malicious software on your mobile phones and do not fall for fake discounts or rewards by downloading apps only from reputable companies. If you report any suspicious activity, immediately check the payment statements and contact the helpline of such an app.

What is e-Wallet Mobile App Development?

Adapting to emerging technologies can only help an organization to survive in an uncertain environment in the long run. e-Wallet mobile apps have increased the market share because of the increase in acceptability by customers.

e-Wallet App Development requires a lot of technical skills and knowledge with ways to provide security to customers of their financial data. The mobile apps should be developed in such a way that it makes it convenient for people to make payments easily and such people should also get security trust.

As a business owner if you are thinking of investing in an eWallet app then it is going to come up with profits and as a customer, if you are thinking of using an eWallet app for making payments then make sure about the reputation and the security policies of such app.

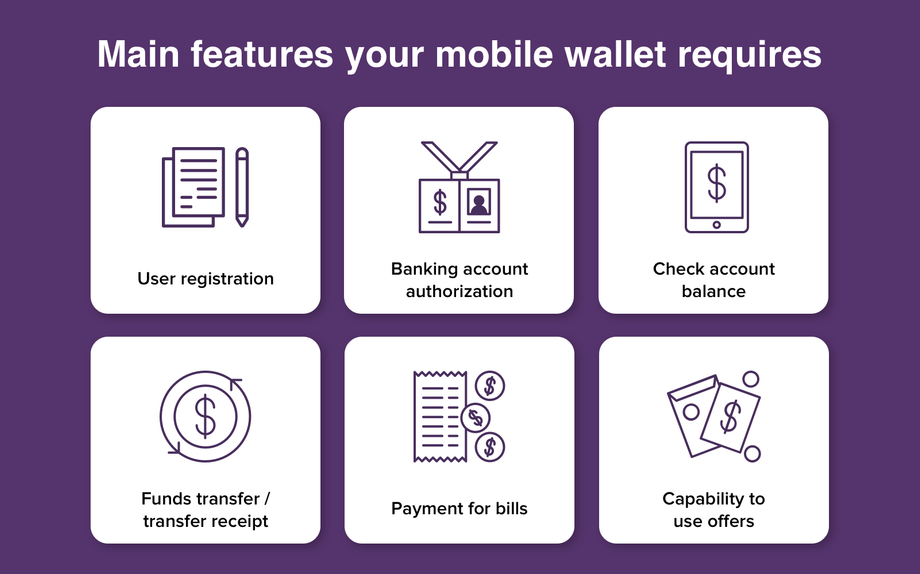

The basic things that should be considered while developing eWallet app are:

- Secure login

- Security management

- Regulatory compliance

- Security policies

- Check balance

- providing payment and receipt statements

It should be made sure that the app provides easy registration for its functioning and should provide clear instructions that could help a user to use such an app properly. Merchant panel should also be separately considered while developing an e-Wallet app containing features like-

- Various EMI payment options

- Discount coupons

- Multi-currency and multi-language support

- Make easy withdrawals

- Create or edit profile easily

- Customer Management

How Much It Takes For Mobile Wallet App Development?

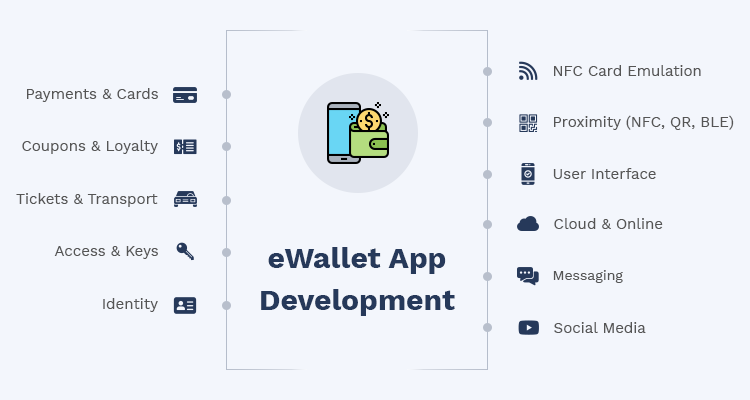

The E-Wallet mobile app development cost depends upon the complexity involved in it. While designing an eCommerce app, the developer should also take into consideration the following things:

- The design of apps should be given a significant priority thus making it easy and understandable for users.

- Technology stack involved in building an app.

- Experience and knowledge of development agencies to ensure effective development of an eWallet mobile app. Selecting an appropriate development agency is very important for this process of app development.

- Creating a proper QR code facility. where customers can make payment by just scanning that QR code considering it easy and quick.

- Encryption should also be considered while developing such apps to ensure proper security as this is considered as one of the most effective and powerful strategies of securing the entire transaction process.

What is p2p App Development?

Nowadays, peer-to-peer (p2p) payment apps are also used to make payments between people. They are considered fast, easy and secure. p2p app is widely used to transfer the payment from one person to another, where that another person could be a friend, client, or relative. Certain uses of p2p apps are:

- Sending money to your close ones

- Dividing any bill among multiple people

- Repayment when any amount is borrowed

- Making payment for any services

While developing a p2p app, the focus should not only be placed on its design but also the security features and various regulatory requirements should also have complied. The app is to be framed in such a way that it should be able to gain customer trust and loyalty by providing efficient security standards. Certain things that should be taken into consideration while developing and p2p app are:

- Immediate transaction notification should be provided on any payment by the user.

- Payment should only be allowed on verification of one-time passwords to ensure security from any unauthorized payment.

- Transaction history shall be provided to the user.

- Chatting features should also be provided to help users to deliver any message or to clarify anything about the payment sent or requested.

- Transferring payment to a bank account facility.

- User digital wallets should be kept secure.

- An efficient admin panel should be provided so that the details can easily be added, edited, or removed by the user.

- A proper login format should be developed to provide confidentiality of information to users.

Conclusion:

Various types of mobile apps for payments are there in India and competition existing in such industries is huge. Therefore, the adoption of an appropriate marketing strategy and the use of customer-friendly technology can help to grow in such a competitive market. While developing any digital payment app, the security and convenience of customers should be on priority. The concept of digital wallet app is constantly and gradually accepted globally in different ways.