Are you a startup owner, product manager, or serial entrepreneur with an inherent desire to start a FinTech company from scratch? Do you need a concise guide that can help you set up a FinTech startup in your quest?

If that sounds like what you need help with, then this article is for you.

What Lies Behind Starting a FinTech Startup?

Starting a FinTech startup entails more than meets the eye. From product launch and marketing to legal compliance, it’s never as simple as it seems.

However, beyond this complexity is a very viable market of financial products. Do you doubt that? Check out the statistics in the section below.

FinTech Market Statistics

FinTech is transforming the financial sector at a rapid rate. It impacts how people use their bank accounts and credit cards, invest, lend, or purchase insurance.

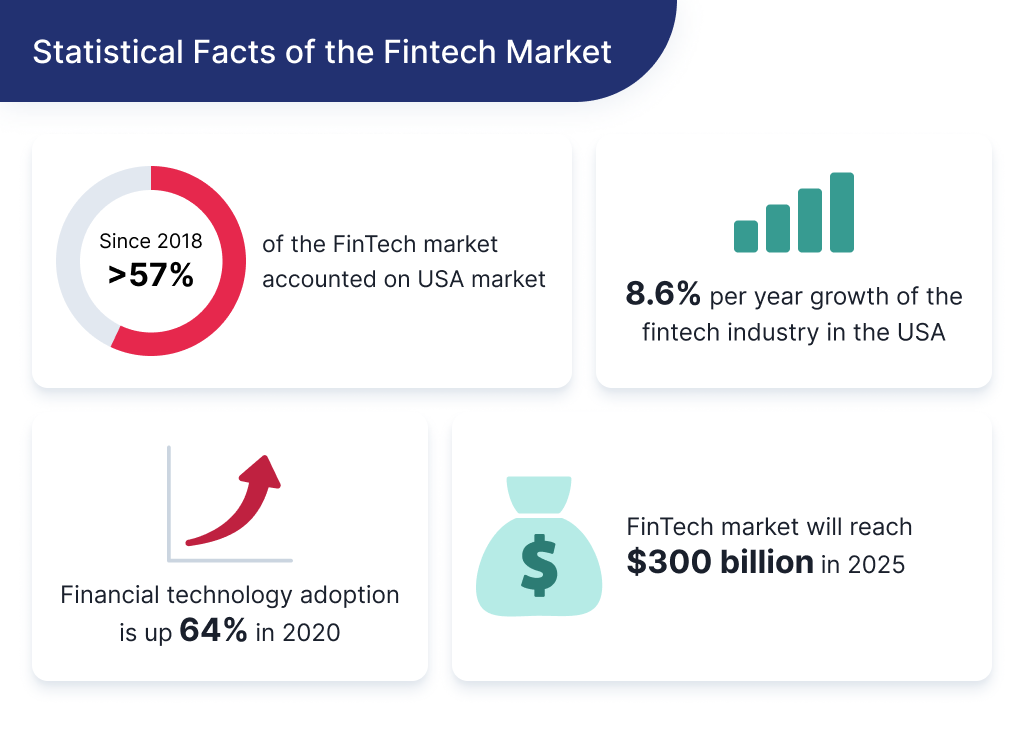

Since 2018, the United States has consistently accounted for more than 57% of the FinTech market.

US-based consumers have highlighted some key benefits they derive from the fintech industry. These benefits include better financial security, simplicity, transparency, personalization, and innovation.

Based on the statistics from Mordor Intelligence, the FinTech industry in the United States has been growing at a CAGR of 8.6%. This growth is expected to continue till 2024.

Here are other impressive FinTech Statistics:

- FinTech market size is going to reach $300 billion by 2025

- Over 10000 FinTech startups exist

- The adoption rate of financial technology rose to 64% by 2020

- Two-thirds of financial transactions are made online

- Stripe is the largest venture-backed FinTech company, and it has a current valuation of $95 billion

- FinTech online payment services are the backbone of e-commerce.

I’m pretty sure you are impressed with those statistics. Now let’s give you hints on how to formulate the right idea to make your startup a beneficiary of these numbers.

How to Start a FinTech startup?

Now that you understand the viability of Starting a FinTech Start. The next step is to start taking steps to create your FinTech startup. Here are the steps to follow so you can get that done:

- Come up with an idea

- Validate your idea

- Categorize your idea

- Check regulations

- Find app development experts

- Start an app development

Now let’s consider the nitty-gritty of what each step entails:

Step 1: Come Up With an Idea

Every venture begins with an idea. To create a unicorn FinTech startup, it’s imperative that you first ruminate on a cut-throat idea that can disrupt the market as you desire.

If you’re an aspiring FinTech startup founder, you should brainstorm yourself or with your decision-making team. Remember the great rule of brainstorming: no idea is wrong.

Jot your thoughts down as they flow so you can further streamline your ideas to the most viable ones.

Consider the pain points of your target market that other financial institutions find difficult to solve. Then proffer solutions to this problem.

To come up with a perfect idea for your FinTech, you should ask the following questions:

- Is there an easier way to X?

- What payment can I make more accessible?

- What can my product improve?

- Is it time to pivot?

Question 1. Is There an Easier Way to X?

FinTech services introduce ease to many financial processes.

For example, Paypal became a successful product because it makes financial transactions super easy. More accessible than traditional banking.

Thus Paypal rose from a great idea on paper to a company with a $51 billion net asset.

Question 2. What Payment Can I Make More Accessible?

Another way to create value is to ruminate on payments you can make more accessible.

For example, numerous payments are still made in cash. You can create a means to make such payments accessible by creating a mobile app for those services.

It’s that simple. You just have to come up with an idea that’s impressive enough.

Question 3. What Can My Product Improve?

Have it in mind that nothing is perfect. That awesome product that’s making waves in the FinTech sector right now can still be improved upon.

Create a detailed list of companies you admire and consider some things you can improve about them.

Some things you can improve about a FinTech product include product features and its delivery process, cost, and customer experience.

Question 4. Is it Time to Pivot?

If you have an original idea, and the market seems to demand an upgraded version of your idea, then you must pivot. To pivot means to change the core of your idea to meet the product/market fit. Each and every startup do pivots: Slack, YouTube, or Groupon.

The reason to pivot lies in the basis of the build-measure-learn feedback loop: you have a set of hypotheses to test. Start with the riskiest ones. If they work, keep developing them. If they don’t work, discard them as quickly as possible, and start creating new hypotheses to test.

Changing from one set of hypotheses to another, up to and including a complete rethinking of the original concept, is called a pivot.

Knowing when to pivot can help your FinTech startup last longer than other competitors in the finance industry.

Step 2: Validate Your Idea

Idea validation is a step that helps to identify the viability of your idea for free or in a cheap way.

Once you’ve carved out a FinTech idea, it’s time to answer the question, “Will it work?” Also, is there a demand for the idea you just came up with?

All that’s what you’ll learn in this step.

Read more about how to start a fintech startup here.