In economics, inflation and recession are considered to be negative terms because both are detrimental. Both can hurt you, but in different ways. Because one is high does not necessarily imply that the other is certain or occurring. They are constantly thrown around in the news. But what do they actually mean?

There are a lot of questions when it comes to inflation and recession. What's the difference between the two? How can you protect yourself from the negative effects of inflation? How to fight inflation? And what about recession? What causes it, and how can you make sure you don't get caught up in it? What is the best thing to do in a recession? Should you make an investment during a recession and if so, what are the best stocks during a recession? We'll answer all these questions and more. We will also discuss what these terms mean, and how they can affect your life.

Difference Between Inflation and Recession

Inflation and recession are terms used to describe an economy's momentum. Inflation causes the economy to barrel ahead at breakneck speed, sometimes beyond control. This means that the purchasing power of a currency decreases. In other words, you would need more money to buy the same amount of goods as you could before.

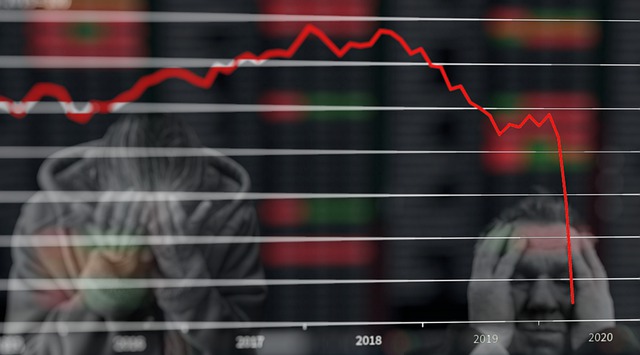

On the other hand, recession causes the economy to come to a grinding halt. Businesses close down, unemployment rises and people's spending power decreases. The National Bureau of Economic Research (NBER) is a non-profit organization that tracks economic business cycles in the United States. They define recession as a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Causes Of Inflation

Inflation is caused by an increase in the money supply. When there is more money available, people are able to bid up prices for goods and services. The most common cause of inflation is too much government spending.

Government spending financed by borrowing can cause inflationary pressures in the economy. This happens when the government prints more money to pay off its debt. The new money enters the economy and increases prices, which leads to inflation. It sounds bad, we will get to how to fight inflation in a moment.

Other causes of inflation include:

● Excessively low interest rates.

● Increasing demand for goods and services.

● Decreasing supply of goods and services.

How will Inflation Affect You?

Inflation can have a number of effects on your life. The most direct way it affects you is through the prices of goods and services. When inflation causes prices to rise, your purchasing power decreases. This means that you can't buy as much with your money as you could before.

Inflation can also have an indirect effect on your lifestyle. For example, if you have a fixed-rate mortgage, your monthly payments will stay the same while the prices of goods and services continue to rise. This can put a strain on your budget as you try to keep up with rising costs.

Inflation may also be a burden for low- and middle-income families who do not have as much money or alternative inflation protection measures to fall back on. Inflation might even push some individuals who have just emerged from poverty right back into it.

How to fight inflation?

When it comes to how to fight inflations, there are two things to discuss. How to fight inflation as an individual and how can Governments reduce Inflation?

The best strategy to handle rising prices is to go back to the roots, keep track of what you spend your money on, have a long-term investment strategy in place, and explore ways to generate more money. The following can be really helpful in how to fight inflation.

● Cut costs: One way to keep your budget afloat is by cutting unnecessary costs. This may include eating out less, canceling subscriptions, or downsizing your home.

● Invest in assets: Investing in assets such as real estate or stocks can help you keep up with inflation. As prices rise, the value of your assets will increase as well.

● Earn more money: If you're not earning enough to keep up with inflation, it may be time to explore ways to make more money. This could include getting a higher-paying job, starting a side hustle, or investing in a business.

Governments usually reduce inflation by increasing interest rates. This makes it more expensive for people to borrow money, which slows down the economy. The government can also reduce inflation by decreasing the money supply. This is usually done by selling bonds, which take money out of circulation. Governments can use wage and price limits to combat inflation, but these measures have proven ineffective in the past. Governments may also pursue a contractionary monetary policy by decreasing the money supply within an economy.

Causes Of Recession

A recession is caused by a decrease in aggregate demand. Aggregate demand is the total amount of goods and services that people are willing to buy. When aggregate demand decreases, businesses sell less and production slows down. This can lead to layoffs and a decrease in incomes.

The most common cause of a recession is a financial crisis. A financial crisis occurs when there is a sudden loss of confidence in the economic future. This can lead to a decrease in spending and investment, which can trigger a recession. We will discuss the best thing to do in a recession in a moment.

Other causes of recessions include:

● A decrease in government spending.

● An increase in taxes.

● A decrease in exports.

How does Recession Will Affect You?

Recessions can have a number of effects on your life. The most direct way it affects you is through your job. If you lose your job or have your hours cut, it can be difficult to make ends meet. You may also have trouble finding a new job as businesses are cutting back on hiring. Unemployment is a sign of recession.

In addition to affecting your employment, recessions can also cause a decrease in housing prices. This can lead to a loss of equity in your home and make it difficult to sell. Recessions can also cause an increase in crime as people become desperate for money. Finally, recessions can lead to a decrease in your standard of living as prices for goods and services rise faster than your income.

The Best Thing to do in a Recession

Recessions have always been followed by a recovery that includes a robust stock market rebound, and is ready to make investments during a recession when it occurs. When the market begins to fall, it's time to act quickly by increasing your contributions or beginning dollar-cost-average in a non-qualified investment account.

The greatest way to invest in dividend-paying businesses is through mutual funds or exchange traded funds (ETFs), which only purchase firms that pay dividends. Consumer staples manufacturers, Grocery Stores, Cosmetics manufacturers, and Alcoholic Beverage manufactures have a good track record of bouncing back during recessions, and there are several different ways to invest in them. These are some of the best stocks during a recession.

Also, keep an eye on real estate during this period as prices will be at an all-time low, so this would be the best time to invest in a property.

The bottom line is that recessions don't last forever and there are always opportunities to take advantage of during these times. By being proactive and making smart decisions, you can protect yourself from the negative effects of a recession and even come out ahead.

Final Words

While inflation and recession may seem like two completely different things, they actually have a lot in common. They are both caused by an increase in the money supply and they both have a direct effect on your purchasing power. Inflation can also lead to recessionary pressures, as people try to conserve their money. The best thing to do in a recession or inflation is to stay informed and make smart choices with your money.

Inflation and recession can seem like daunting concepts, but it's important to understand how they work and how they can affect you. By being informed and making smart decisions, you can protect yourself and even come out ahead.